UK construction activity suffered its sharpest fall since Q1 2013 as private developers hit the brakes ahead of the general election, according to new figures from industry analysts, Glenigan.

UK construction activity suffered its sharpest fall since Q1 2013 as private developers hit the brakes ahead of the general election, according to new figures from industry analysts, Glenigan.

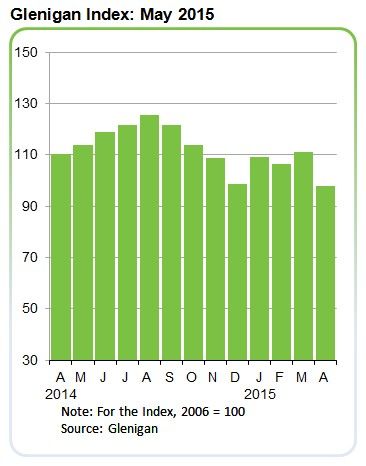

The Glenigan Index for May, which covers the value of projects starting on site during the three months to April, has declined by 11% year on year as office, retail and industrial activity plummeted.

The contraction in non-residential activity is the sharpest since December 2009, with the underlying value of project starts 21% lower than a year earlier.

Office starts fell by 50% compared to a year ago, with the retail and industrial sectors decreasing by 32% and 27% respectively.

The hotel and leisure sector, by contrast, has remained in growth mode over the last three months, although the pace of expansion slipped to 11% from the 31% rise in the three months to March.

Private housing also represents a brighter spot, with a four per cent rise in the value of projects. However, overall residential sector growth was just one per cent, dragged back by a six per cent decline in social housing starts.

Allan Wilén, economics director at Glenigan, said: “The pace of expansion in the commercial sectors has eased over the last six months, driven by a combination of a firming comparison base and an easing in investment across the economy during the second half of 2014.

“However the recent sharp decline is a break in this trend, and suggests a wholesale decision to ‘wait-and-see’ by private sector clients and developers.

“We expect construction starts to spring back during the second half of the year, so long as a credible government is formed and the prospect of a second general election later in the year fades. This would mitigate the impact of the recent slowdown.

“Continued improvements in planning approvals add weight to the view that this is a pause rather than a permanent shift in market conditions.”

Civil engineering activity has taken a hit over the last three months, with project starts down ten per cent, reversing the 11% growth seen in the three months to March. A longer run view of the sector suggests that it is growing, but at a modest pace. In the 12 months to April starts rose by two per cent compared to the previous period.

Education starts also contracted sharply, with universities appearing to delay schemes until after May 7. The underlying value of starts of university projects plummeted from over £400 million a year ago to under £100 million during the latest period – the weakest quarterly total since the end of 2010.